With solar energy being increasingly used in America, where more than 700,000 homes have installed solar panels, it’s time to join the bandwagon. You are not only saving the planet’s deteriorating climate, but you’ll also be spearing a few bucks in electric bills.

Despite the decreasing costs of solar panels in recent years, many people still find it challenging to finance their solar installations. While some homeowners and businesses have the financial capability to buy solar panels in cash, not many people fall in that category, and that’s where leasing opportunities come in handy.

The dilemma is whether to buy solar panels using loans or simply lease them. Quickly put, both options have their separate advantages and shortcomings.

And you should make the decision based on factors like – your financial goals, your FICO score (for loan qualification), efficiency, and whether you’re a homeowner or renting.

In comparing the two options, it’s important to look at both sides comprehensively and weigh all the options.

What’s the Difference?

There isn’t much of a difference really, other than ownership. When you buy a solar panel, either through cash or via loan, you’ll own it. But if you lease, the solar panel belongs to the company leasing it to you.

While ownership is the obvious route to take, there are situations where leasing becomes attractive. If you want to jump into green energy, the easiest and cheapest way to start is by leasing or PPA (power purchase agreement). There’s no upfront money needed.

All you have to do is contact the solar leading agency, and they’ll come right away to install the solar panels. Of course, as a procedural requirement, you’ll need to sign an agreement with the leasing firm before everything is installed.

The advantage of leasing solar panels is that you’re relieved of having to deal with taxes, maintenance costs, or worrying about what might happen to the panels. That’s because you don’t own anything. All you have to do is pay your monthly bills.

On the other hand, buying solar panels comes with the stress of maintenance costs and paying interest rates on the loan you’ve taken to purchase the system.

Here’s a table summary of their differences:

| Leasing | Cash Buying/Loan Financing | |

| Upfront Costs | None or Very Minimal | Not Applicable |

| Long-Term Savings | Not so good | YES |

| Ownership | None | YES |

| Federal Tax Qualifications | None | YES |

| SRECs Qualifications | None | YES |

| Free Maintenance | YES | None |

| Easy To Sell Home | Not | YES |

Why Buying or Financing Solar Panels is Good Investment

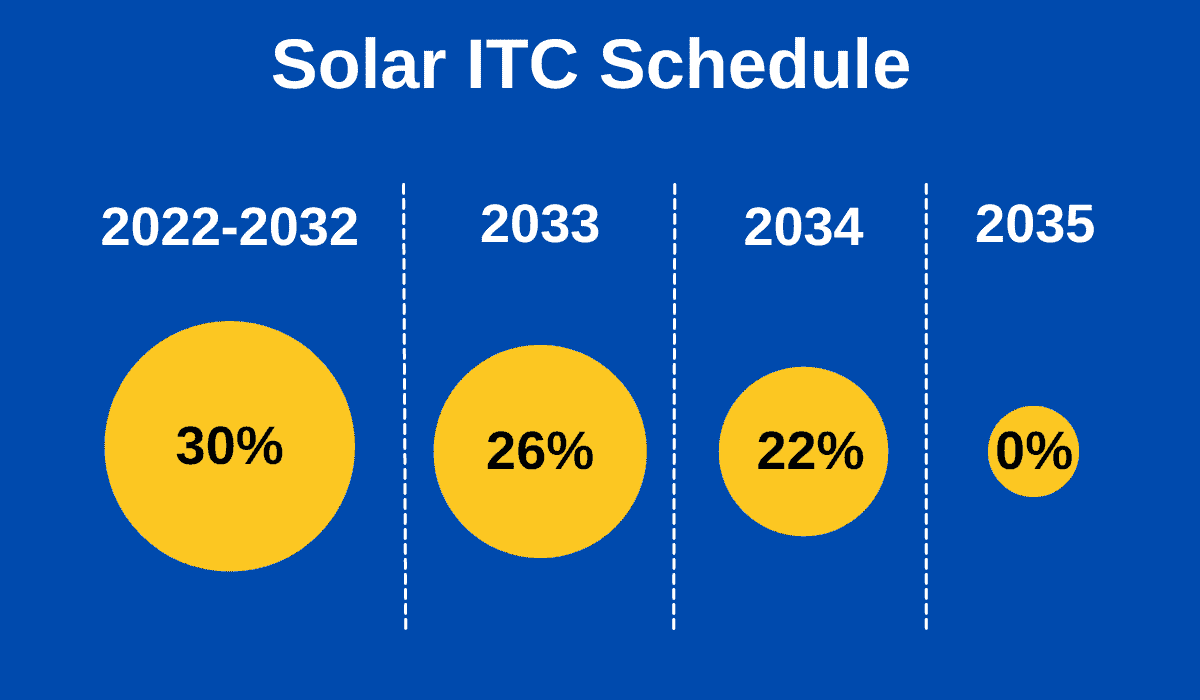

The overall expense compared to leasing is much, much cheaper. Also, you’re always eligible for federal tax benefits, which means you can save up to 50 percent of the initial cost through cash rebates and any incentives offered by your local government for embracing solar energy and going green.

You don’t have to worry about escalator clauses in leasing contracts, which can eat into your savings by increasing annual payments by 3 percent. Remember that the leasing companies are looking to make profits with you. This means they’ll include clauses guaranteeing their profits.

Also, even though we are never sure of future outcomes, we can’t run away from inflation rates, which are always on the rise. Therefore, depending on the agreement with the leasing agency, you may end up incurring more costs in the future.

When financing a solar panel, you have to reach into your pocket to incur maintenance costs. I know that’s a bummer! But that shouldn’t be much of an issue.

You still have a warranty on the solar panels, which in most cases can last up to 25 years. You just have to get the right solar panel seller whose warranty includes a few repairs and maintenance terms.

Whenever you want to sell your home, you’ll be attracting buyers. But that’s mostly advantageous if you’ve already paid off your loan, or you bought the panels in cash.

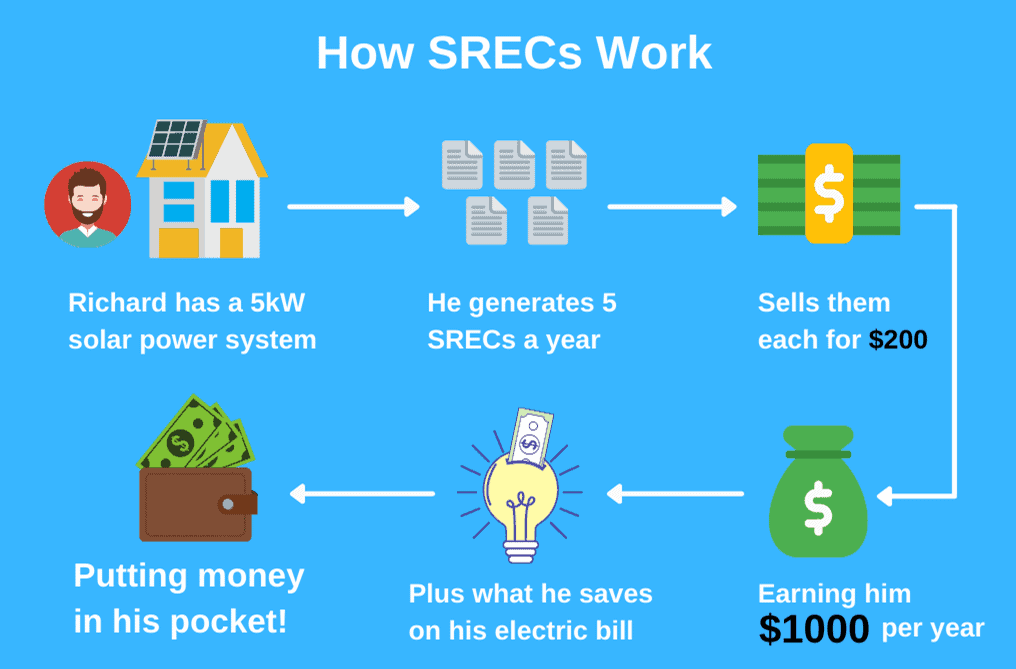

Other benefits include the Solar Renewable Energy Certificates (SRECs) offered by the government. SREC is a form of rebate where, as someone owning solar panels, you are compensated $200 once you’ve accumulated 1000 KWh of energy.

The energy you’ve accumulated is sold to power companies, which are required by law to acquire some of their power from renewable sources of energy like solar.

When Leasing Solar Panels Makes Perfect Sense

As we’ve already mentioned, leasing solar panels is advantageous because you don’t have to worry about the upfront costs of acquiring a solar panel.

Leasing is the best option if you don’t qualify for a loan to finance solar panels, but you don’t want to incur your current expensive electric bills. Solar panels are generally cheaper whether leased or otherwise.

If you’re the kind of person who loathes dealing with federal taxes and incurring monthly interest rates, then leasing is what you need. When you lease, your only worry is the monthly payment on solar energy you’ve used.

Better yet, maintenance is typically not a problem as it is generally handled by the leasing company. If the leasing firms are using older models, which require constant maintenance, then you’ll be dodging a bullet leasing the panels.

With technological advancements, you don’t have to worry about spending on a solar panel that’s going to be outdated.

One concern people may have is the possibility of purchasing an outdated version of a solar panel. However, we still don’t know how advanced the new panels will be.

And even if there will be better versions in the future, you’ll have spent money on leased panels. This doesn’t make much of a difference.

In essence, there are situations where leasing solar panels are the only option.

- If you are not able to access federal tax credits

- If you are not qualified for a loan to acquire solar panels

- If you are not eligible for SRECs and other rebates

Why Leasing Isn’t a Good Idea

When you lease solar panels, you’re missing out on federal tax benefits and incentives, which reduce your overall expense. With a lease, you’ll be saving less compared to buying. Of course, leasing solar panels is tempting, because there isn’t upfront money needed. But that’s going to bite in the long run.

Even though buying solar panels (or financing using a loan) seems very costly in the beginning, most states and local governments offer incentives that can cut up to 50 percent of your overall expense.

Worse, most solar power leases contain escalator classes, which can increase your annual payments by 3 percent. For example, if your lease payments are at 25 cents per KWh a year, a 3 percent escalator means you’ll be paying 37 cents per KWh after 15 years. That’s a yearly incremental of 3 percent.

If you own a home, and you’ll want to sell it in the future, leasing solar panels isn’t a great idea. Leasing solar panels tends to scare off home buyers. No one wants to be stuck paying off leasing agencies without ever owning the solar panels.

The leading buyouts are always expensive. And that’s only if the leasing agencies allow it. Some of them don’t.

When you lease solar panels, you lose control of your roof. Since the panels belong to the leasing company, they’ll be installing them in such a way that other neighbors can see so as to advertise their products. The installation will disregard your home’s appearance.

Questions to Ask Yourself before Financing Solar Panels

What’s your FICO Score?

First off, you need to know if you really qualify. The last thing you want is financially straining yourself.

What’s the payback period?

Do your maths and make sure the payback period doesn’t go more than ten years. Anything more than that isn’t recommendable. Still, depending on your financial capability, the payback period can surpass ten years, as long as you don’t strain yourself.

What’s the loan interest rate?

As a rule of thumb, interest rates shouldn’t be too high. And it’s best to consider either fixed or flexible rates depending on your finances. Flexible rates will always change as per the inflation rate.

Are the panels of high quality?

A little research goes a long way. It’s best to make sure the solar panels are of the latest models, which will require minimal maintenance.

What’s the maintenance cost? Before taking a loan to buy solar panels, make sure the panels come with warranty and that the brand offers some form of maintenance. Also, opt for solar panels that come with an app for tracking the solar panels.

Are you eligible for federal tax benefits?

It is best to check for incentives offered by your local government. This can save you lots of cash on overall expenditure.

What’s the Best Way to Pay for Solar Loans?

The best option is via home equity line of credit, which is cost-effective. The option comes with low interest rates because your home will be serving as collateral.

Better yet, such equity loans feature repayment period of up to 20 years, which gives you enough time to pay for the solar loans.

Additionally, when it comes to solar panel loans, you have the choice of secured and unsecured loans.

With unsecured loans, interest isn’t tax deductible because your house doesn’t act as collateral. The best advice is to compare different loan offers and choose the cheapest one.

Verdict

From the analysis and comparisons, it’s best to buy than lease solar panels. It’s beneficial from a long-term perspective.

However, there are situations when leasing solar panels makes perfect sense. Leasing doesn’t require any upfront money or deposits. The leasing agencies take care of everything, which includes maintenance costs and dealing with federal tax.

Leasing is also the best option if you are not eligible for federal tax incentives, or your FICO score doesn’t qualify you for a loan to buy solar panels.

Nonetheless, if you can acquire a loan of some sort, then financing solar panels is highly recommended. You’ll be saving a lot despite having to deal with monthly interest rates, occasional maintenance costs, and paying taxes.