Solar energy is Earth’s cheapest and most abundant renewable energy resource. Tapping into it can help you save on energy costs and reduce dependency on fossil fuels. However, many Americans find solar panels and their associated systems costly and out of reach.

Leased solar is the most affordable path to acquiring solar panels. You can lease solar equipment in the same way you lease a car. Leased solar allows you to enjoy energy savings on day one with zero upfront costs. All you need to do is pay the monthly rates.

This article tackles the intricacies of leased solar, including the associated pros and cons. We’ll also explain how solar leasing works. But before we get into all that, what is a solar lease?

What is a Solar Lease?

A solar lease is a third-party ownership scheme popular in solar adoption. It is a financial agreement between you, the homeowner, and a solar developer. The developer provides and installs solar equipment while you pay fixed monthly payments.

A solar lease works like a car lease. The lease terms require you to make monthly payments for the duration of the lease. It’s like paying your electric bill, except it’s lower, and the funds go to the solar developer. Apart from installation, the solar developer handles equipment and system maintenance.

In a solar lease, you don’t own the solar panels; the solar developer does. Therefore, you can’t claim federal tax credits or other solar power incentives. This privilege belongs to the solar company that owns the solar panels.

Solar leases are attractive because they are a cheaper path to solar acquisition. You don’t have to pay a sizable deposit. You can start enjoying energy savings immediately.

How Does Leased Solar Work?

Leased solar allows you to enjoy solar power’s benefits without the high costs of buying solar equipment. When leasing solar, you don’t own the solar panels and associated equipment. But you’re paying for the privilege of using solar equipment.

Most solar lease agreements last for 20-25 years, which is the expected life of a solar panel.

To lease solar power, you’ll need to find an entity that offers these services. Let’s say you find a company called Solar Solution-X. You like their rates and are interested in employing its solar leasing services.

Solar Solutions-X will offer you one of two solar leasing options. These options include:

- A fixed monthly lease

- A Power Purchase Agreement (PPA)

Types of Solar Leases

There are two kinds of solar leases; the fixed monthly lease and the Power Purchase Agreement.

1. Fixed Monthly Lease

For a fixed monthly lease, you pay a flat monthly fee for the duration of your lease. The monthly payments in this plan are fixed and do not fluctuate with power consumption.

For example, you enter a fixed monthly lease with Solar Solutions-X. The terms of the agreement demand that you pay a flat fee of $100 per month. For the duration of the lease, you will pay $100.

Fixed monthly leases may feature a price escalation plan. More on that later.

2. Power Purchase Agreement (PPA)

For a Power Purchase Agreement (PPA), the solar developer charges you based on the power generation or consumption. The company sets a rate for every unit of power (kWh).

For example, you enter into a PPA agreement with Solar Solutions-X. They charge 20 cents for every kWh generated by their systems. In April, you consume 200 kWh of power. You’ll get a bill of $40. If you consume 300 kWh in May, you can expect a bill of $60.

Power Purchase Agreements can benefit you if you’re a light consumer. Instead of paying $100 like everyone else, you pay as low as $40 in some months.

Solar Installation

After agreeing to the terms of your lease, the solar developer installs their system on your home. A typical solar set includes solar panels, power inverters, and tracking meters.

During the day, solar panels generate energy to power your home. When there’s a surplus, the system feeds the grid. When this happens, you can notice the tracking meter winding backward.

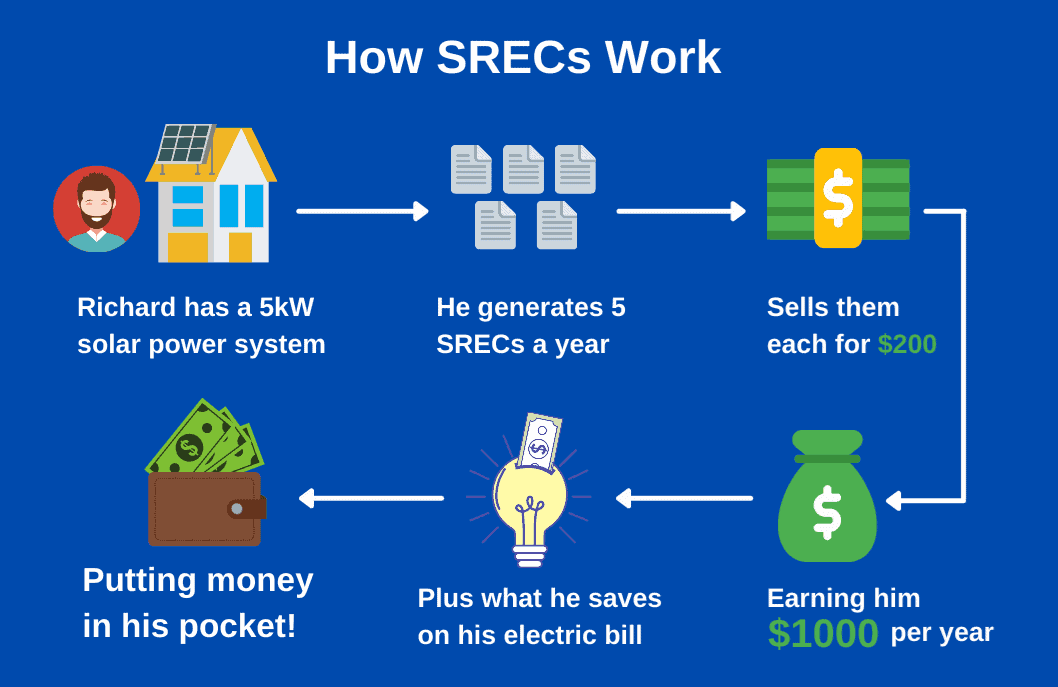

In a PPA plan, you’ll pay less because your consumption is reversing. The solar developer collects Solar Renewable Energy Credits (SRECs) from the power company. SRECs have a monetary value.

The absence of the sun at night paralyzes power generation. So, your home pulls electric power from the grid.

The solar company is responsible for maintaining its solar equipment and systems. When you stumble upon any problems, it’s best to call them.

Advantages and Disadvantages of Leased Solar

Leased solar agreements come with various pros and cons. Let’s look at each so you can grasp the full picture of leasing solar.

Advantages of Leased Solar

Below are the benefits that you can expect from leased solar:

1. No Upfront Cost

Leased solar is a cheap pathway into solar acquisition. Sure, you don’t own the solar system, but you enjoy the benefits of solar power. And all for zero upfront fees.

A 6 kW solar system costs between $10,000 – $15,000. Even if you were to finance such a purchase with a bank loan, you’d have to put some money down.

With leased solar, you can enjoy solar savings on day one, with zero upfront costs. No installation fees are necessary.

2. Lower Energy Bills

Leased solar monthly rates are lower than your average electric bill. The average cost of electricity in the United States is 11.18 cents per kWh. In New York, the rate doubles to 21.88 cents per kWh.

Some solar companies offer PPA plans for as low as 7 cents per kWh. Solar energy is cheaper than traditional electricity.

3. You’re Not Responsible for System Maintenance

With a leased solar plan, you’re not liable for system maintenance and associated costs. The solar developer is responsible for maintenance.

Since modern solar systems are low maintenance, this benefit doesn’t sound so great. It sounds like a phrase companies throw around on their marketing material.

But should anything go wrong with your solar system, it’s nice to know that the solar developer has you covered.

Disadvantages of Leased Solar

Below are some of the disadvantages that come with leased solar:

1. You’re Not Eligible For Tax Credits and Other Solar Incentives

With leased solar agreements, you don’t own the solar panels. So you can’t claim any tax credits or solar incentives. The federal solar tax credit, which used to be 30% but has decreased over time, goes to the solar developer. Solar Renewable Energy Credits or SRECs, which have monetary value, also go to the solar developer.

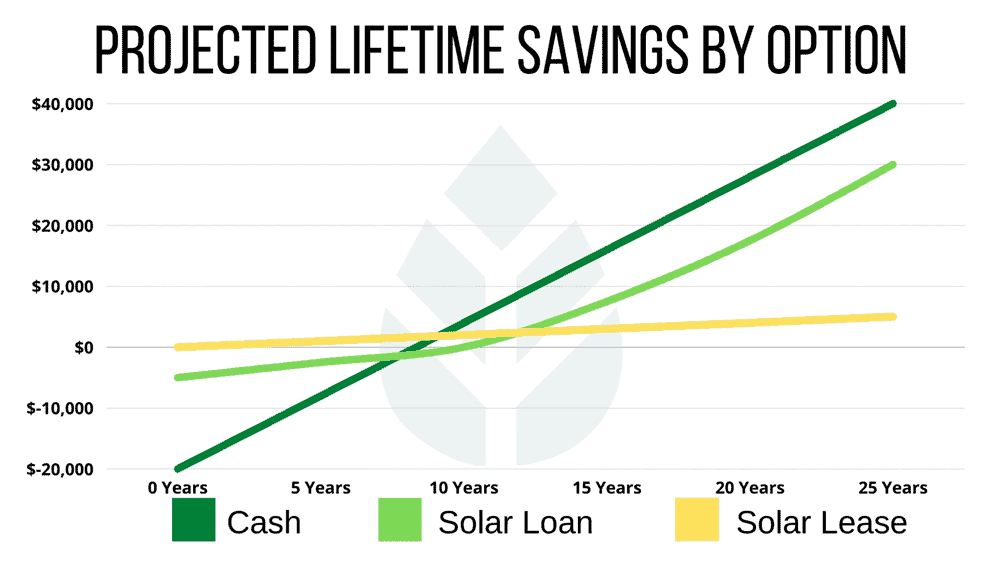

2. Lower Long-Term Savings

Leased solar is cheaper than traditional electricity. But it is more expensive, long-term, than buying solar panels. When you buy a system, it takes quite a while before you recoup your investment (typically 5-11 years). Then you can forget about electric bills for the next 14-25 years.

Leased solar doesn’t offer such an opportunity. You’ll have to contend with monthly payments for the entire duration of the lease (20-25 years).

3. Price Escalator

Leased solar rates increase by small amounts yearly, usually 1-5%. This tendency to increase costs is what we call price escalation. Let’s say you signed up for a fixed monthly lease that features payments of $100. Let’s also assume that the plan features a price escalator of 1% per annum.

In the first year, you’ll be paying $100 monthly. In the second year, your payments will increase by 1%, and you’ll be expected to pay $101. By the time you get to your 20th year, you’ll be paying $123.61 monthly.

While electricity prices have increased over the years, they don’t rise with this consistency.

3. Leased Solar Does Not Add to the Value of Your Property

Solar panels increase your property’s value, but only if you own them. Leased solar panels do not add to the value of your home.

4. They Complicate the Sale of Your Property

Solar panels do make a property more attractive. A buyer will see them on the roof and picture future energy savings. But things may get complicated as soon as they learn that the solar panels are on lease.

Some buyers would be happy to take over the lease. But others will grow cold feet. Just mentioning “leased solar” is enough to confuse and scare some potential buyers. Some people are not willing to deal with the process of terminating a lease agreement.

While solar panels make your property more attractive, solar leases can complicate a home sale.

Recap: How Does Leased Solar Work?

Solar panels are not cheap. A fully kitted system can cost up to $15,000. Leased solar is one of the more affordable paths to acquiring solar panels. It offers you day-one savings at zero upfront costs.

Leased solar is a third-party financing option where the solar developer lets you use their products at pre-determined monthly rates. Solar leases can last up to 25 years, which is the life of a solar panel.

Leased solar has its pros and cons.

Pros:

- Reduced utility bills

- Zero upfront fees

- You’re not responsible for system maintenance

Cons:

- You can’t collect financial incentives

- Low long-term savings

- Features a price escalator

- Doesn’t add property value

- May complicate the sale of your home

With the information above, you can weigh the pros and cons and decide whether leased solar is the right option for you.